Here are some resources to get you started.

BENEFITS

Automate end-to-end compliance for WooCommerce workflows

Streamline integration

Avalara integrates with WooCommerce, offering a single connection to a global compliance platform.

Increase accuracy

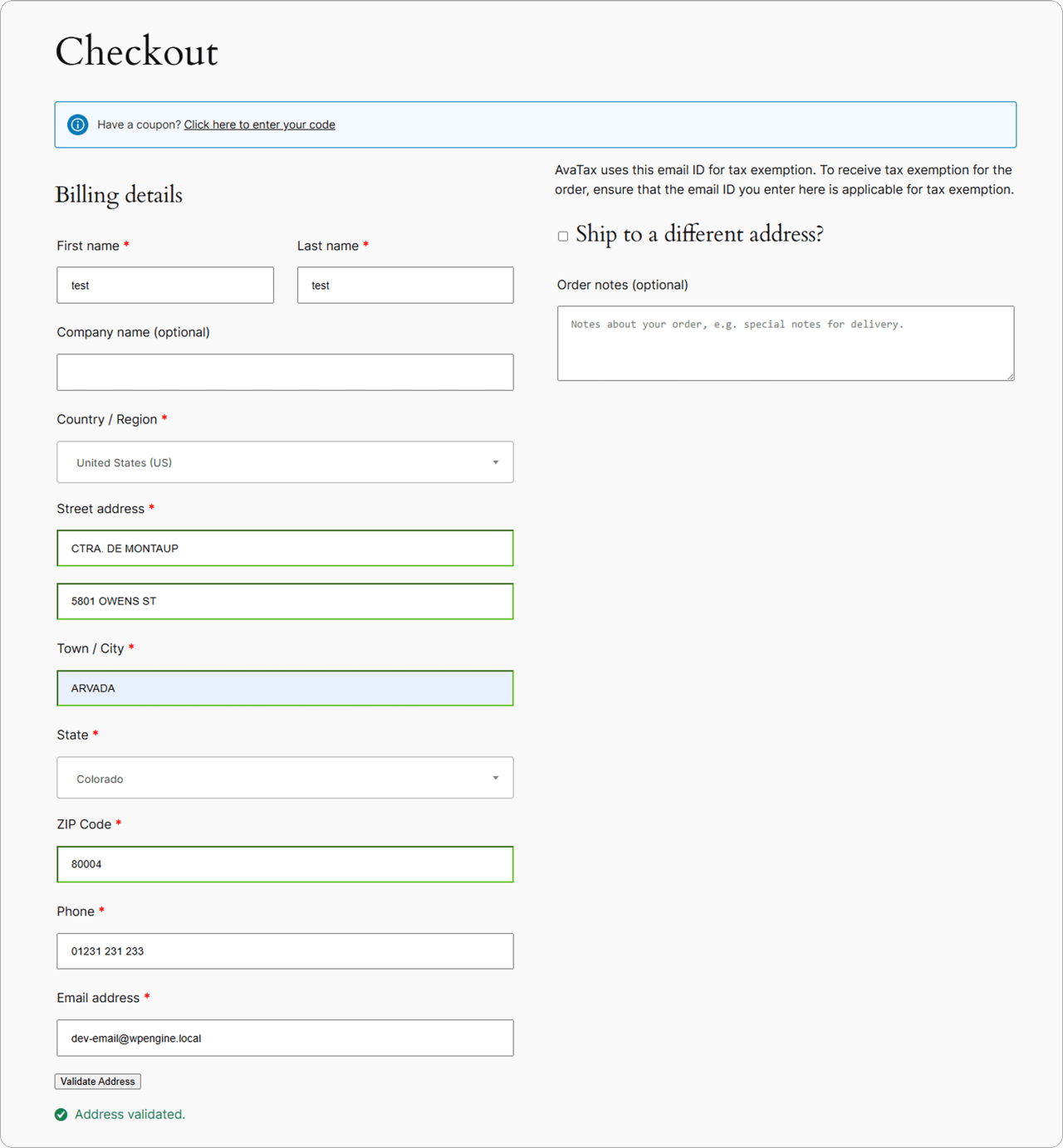

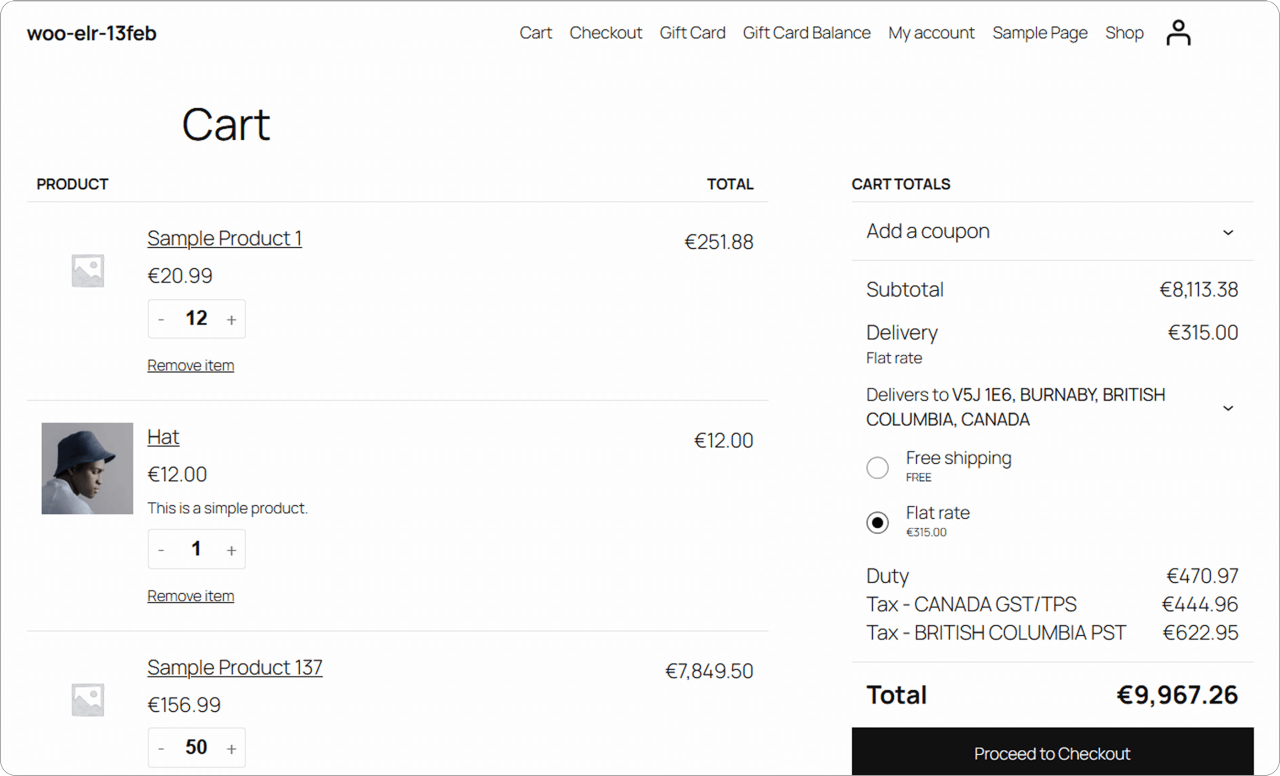

Enable the Avalara tax engine to improve calculation accuracy with regularly updated rates based on geolocation, item taxability, new legislation, and regulations.

Assess tax obligations

Determine where and when you need to collect and remit sales tax based on ever-changing physical and economic nexus state laws.

Manage exempt sales

Automate the creation, collection, verification, usage, and storage of exemption certificates to improve compliance efficiency and audit readiness.

Automate returns filing and remittance

Offload costly, time-consuming returns preparation, filing, and remittance for all jurisdictions every filing cycle.

Scale to accommodate growth

Products and solutions from Avalara work together and scale, helping you to maintain tax compliance as your business grows and evolves.

How it works

Plug the power of Avalara into your WooCommerce workflows

Related products

Apply more accurate, regularly updated tax rates based on location, taxability, legislation, and more.

Drive cross-border sales with a unified checkout solution that optimizes customer experience.

Calculate VAT quickly and more accurately to improve tax compliance across the EU and U.K.

Process, collect, and access exemption documents.

Enable the transmission of e‑invoices and tax data.

Offload the hassle of returns preparation, filing, remittance, and notice management.

CUSTOMER STORIES

See what our customers have to say

Dive deeper

EXPLORE

IMPLEMENT

USE

Frequently asked questions

How does Avalara for WooCommerce differ from other tax compliance solutions?

Avalara for WooCommerce offers a single connection to a global compliance platform, helping you automate and manage your compliance end-to-end. The integration with WooCommerce enables Avalara AvaTax, an advanced solution that uses geolocation and address verification to calculate sales tax down to a specific address, accounting for multiple tax jurisdictions in a single ZIP code, complex tax tiers, and more. If you need to calculate tax on international transactions, AvaTax offers options for that too. Avalara also has solutions to prepare and file your returns, easily manage exemption certificates in the cloud, and deploy e-invoicing and real-time reporting.

How do I install Avalara for my WooCommerce online store?

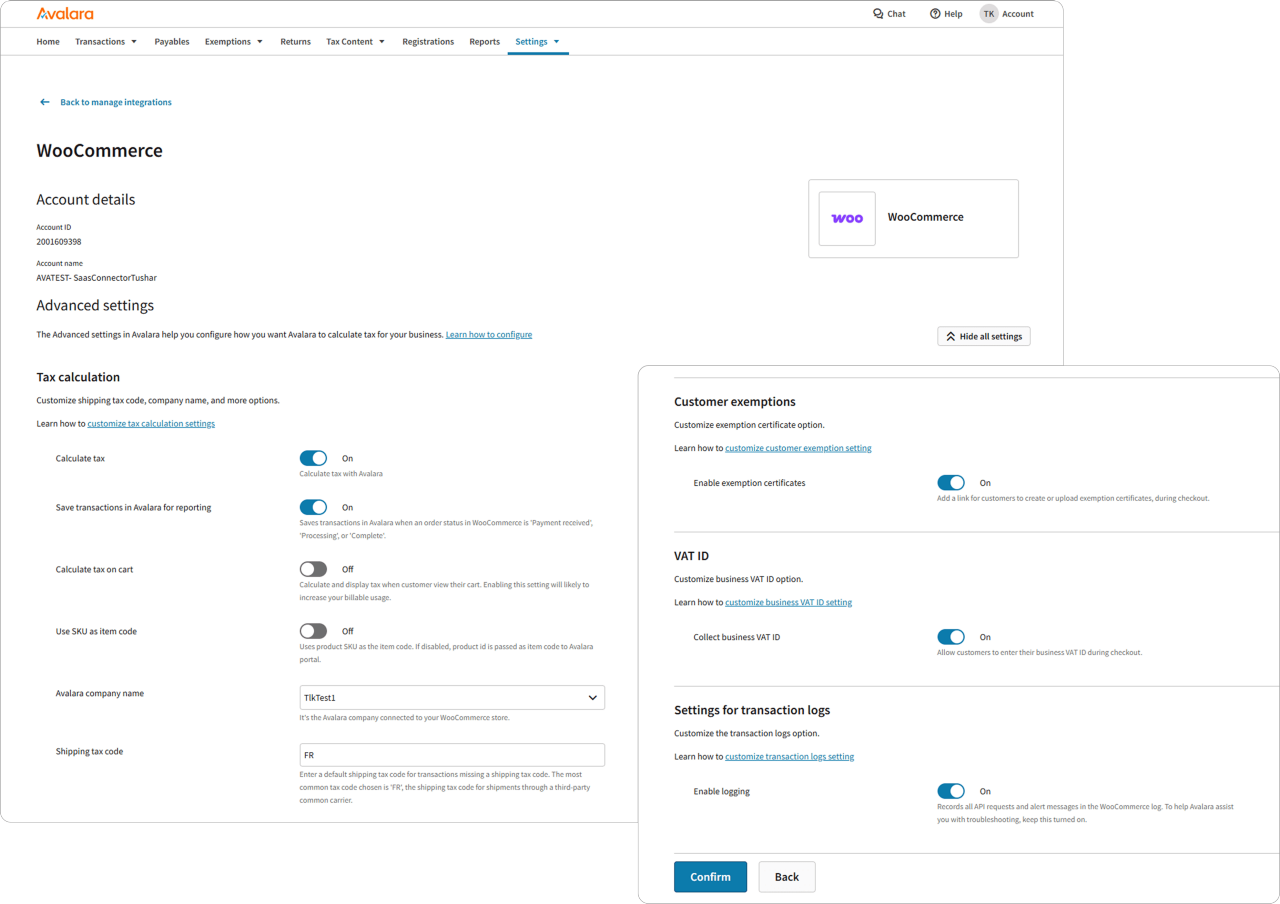

Download the AvaTax extension from the Woo Marketplace

Purchase an AvaTax plan online or contact Avalara to get an AvaTax account

Log in to your AvaTax account to get your account number and license key

Input your account number and license key within your WooCommerce settings

Set up and save your tax codes and settings for your store. For more information, see here.

Do you offer an annual or monthly agreement? Does it renew automatically?

Avalara provides a 12-month agreement that you can pay annually or in monthly installments. Agreements automatically renew at the end of each term, but you can cancel before your new term begins, according to our terms.

Is usage measured annually or monthly? Will any unused portion of my plan roll over to the next year?

Annually. If your plan allows for calculations on 1,000 transactions a year, for example, you can use those transactions anytime during your annual subscription term. Transactions don’t roll over and must be used within the subscription term in which they are purchased.

Does Avalara provide support?

Yes, you’ll have unlimited access to the Avalara Global Support Portal. More advanced support packages are also available to purchase.

I have multiple companies. Will Avalara work for me?

Yes, AvaTax will manage your tax compliance across multiple companies, even across complex corporate structures (such as parent/child companies).

Connect with Avalara

See how easily our solutions work with WooCommerce.